Earnings Call Highlights: TriSalus Life Sciences (TLSI) Q2 2025

Management View

- CEO Mary T. Szela mentioned that the company achieved $11.2 million in net sales during Q2 2025, representing a 52% increase compared to the same period last year and a 22% rise from the previous quarter. She pointed out the introduction of the TriNav FLX infusion system, the completion of a $22 million private placement, new clinical uses, broader market potential, and simplification of the capital structure via a preferred stock exchange. Szela said, "We're excited to have [David Patience] join the team... as we move forward with our next stage of growth."

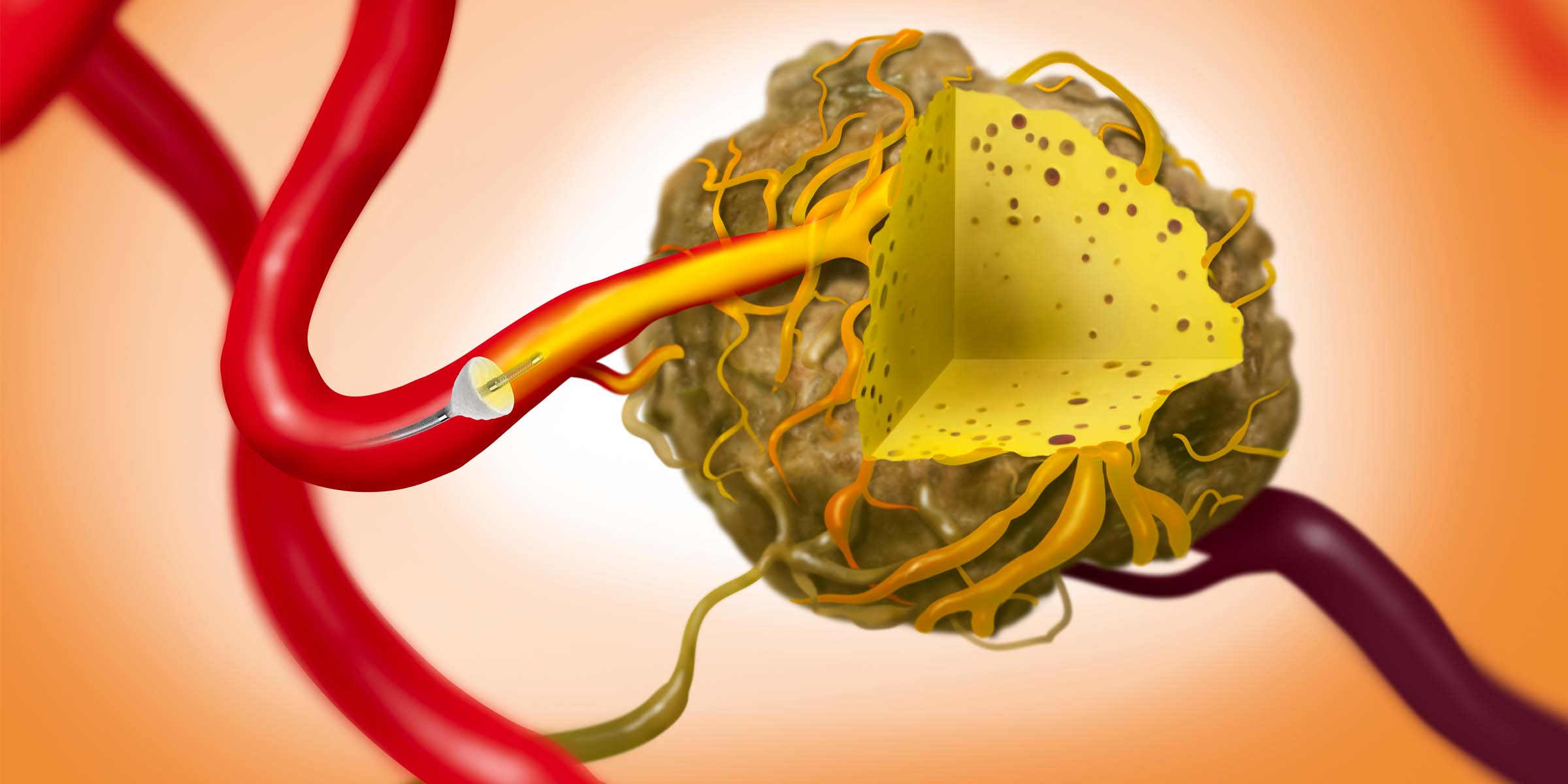

- Szela explained that TriSalus is concentrating on implementing a strategy to grow its pressure-enabled drug delivery (PEDD) platform, advancing collaborations for nelitolimod, and creating long-term value through product innovation and market expansion. She stated, "We believe TriNav is well positioned to become the standard of care in liver embolization for complex patients."

- CFO David B. Patience stated, "The revenue for this period reached $11.2 million, representing a 52% rise compared to the same period last year and a 22% growth from the previous quarter." Patience also mentioned that the number of unique order accounts increased by 28% over the past year, and the gross margin for the quarter stood at 84%.

Outlook

- Szela stated again, "We are reiterating our guidance of 50% revenue growth to show our confidence in future expansion." She mentioned that the company is "dedicated to enhancing EBITDA results while also choosing to invest in key areas of the business," aiming for positive cash flow and EBITDA by 2026. The company anticipates expenses related to nelitolimod to conclude by the end of 2025, with no additional development costs planned for 2026.

- Management's statements and projections stayed positive, with Szela noting, "Moving forward, we are starting the second half of 2025 with favorable conditions."

Financial Results

- Patience recorded sales and marketing expenses of $7.2 million, an increase from $6 million in the previous quarter, driven by growth efforts. General and administrative costs amounted to $5.7 million, including about $1 million in one-time legal and audit expenses. Research and development costs totaled $3.9 million, a decrease from $4.7 million in the prior year, as trials for nelitolimod concluded.

- Q2 operating losses amounted to $7.3 million, down from $8.2 million in the same period last year, while adjusted EBITDA loss decreased to $5.3 million from $6.7 million. At the end of the quarter, cash and cash equivalents totaled $26.5 million, which includes the $22 million raised in April. Patience stated, "We have enough liquidity to cover operations through 2025 and anticipate achieving positive cash flow in early 2026."

- The firm stated that 99% of preferred shares were submitted and converted, leading to roughly 50 million common shares outstanding and removing the 2027 reset clause.

Q&A

- Nelson Cox (Lake Street Capital Markets): Questioned regarding the effect of the updated mapping code. Szela replied, "We're genuinely beginning to observe that medical professionals are recognizing the swift implementation of this. And that's significantly supporting some of the progress we're currently experiencing."

- William John Plovanic (Canaccord): Requested more details regarding unique ordering accounts and product contributions. Patience responded, "Unique ordering accounts increased by approximately 10% compared to the previous quarter... our main emphasis over the past few years has been significantly expanding the number of accounts, and now we are moving our focus towards increasing usage per account."

- Plovanic also asked about TriNav FLX and TriGuide. Szela responded, "FLX, which we recently introduced, is actually surpassing our expectations. This technology truly tackles tortuosity, where doctors... felt amazed, I couldn't maneuver a TriNav to the spot I wanted."

- Matt Park (Cantor Fitzgerald): Inquired about challenges affecting gross margins. Patience responded, "We believe we can return to positive trends in gross margin following a small setback during the quarter... this is something we are confident we can recover from."

- Seamus (Oppenheimer): Asked about the adoption of mapping code and the timeline for the nelitolimod partnership. Szela stated, "Since April, it's really starting to grow... we're seeing a significant acceleration after the reimbursement." Regarding nelitolimod, "We aim to release the data in Q3... once we have the final results, we'll start those conversations in Q3."

Sentiment Analysis

- Analysts often requested additional information regarding product adoption, the influence of mapping code, operating expenses, and recovery of gross margins, indicating a somewhat positive yet cautious outlook. There was specific curiosity about how the mapping code affects growth and assurance in meeting forecasted goals.

- Management kept a positive and forward-looking tone during the call, using statements like "we are reaffirming our guidance," "we are confident," and "we believe TriNav is in a strong position." During the Q&A, the responses were detailed, and management emphasized their strategic progress and momentum, with no signs of defensiveness or avoidance.

- In comparison to the prior quarter, the management's tone stayed the same, whereas analysts in Q2 demonstrated a somewhat greater emphasis on operational leverage and the uptake of new products.

Quarter-over-Quarter Comparison

- Revenue increased from $9.2 million in the first quarter to $11.2 million in the second quarter, with year-over-year growth rising from 42% to 52%.

- Sequential growth in unique orders declined, but management highlighted a focus on increasing usage per account rather than just opening new ones.

- The introduction and market acceptance of TriNav FLX and TriGuide occurred in Q2, with early sales surpassing internal expectations.

- Gross profit margin remained at 84% in both Q1 and Q2, although management attributed the lack of change to inefficiencies in producing new products, while anticipating future enhancements.

- Both the operating loss and adjusted EBITDA loss showed improvement compared to the prior quarter.

- The management's strategic move to collaborate with nelitolimod and cut associated costs by the end of 2025 was confirmed, as the company emphasized its commitment to device innovation and business growth.

- The analyst's attention became more concentrated on operational costs, product-specific usage, and the effect of mapping code, in contrast to the previous quarter's more general business and pipeline-related inquiries.

Risks and Concerns

- Decline in gross margin attributed to reduced manufacturing efficiency with new products was recognized, as management expects enhancement with increased production.

- The organization mentioned continuous funding in sales and marketing as a reason for the delay in achieving EBITDA and cash flow profitability until 2026.

- Discussions regarding the Nelitolimod partnership are influenced by market conditions, with management stating, "the current biotech market is not as strong as I would prefer."

- Higher general and administrative expenses were caused by one-time legal and audit fees, with a strategy in place to reduce these going forward.

- There is dependence on ongoing reimbursement clarity and implementation to align procedures with TriNav's expansion.

Final Takeaway

TriSalus Life Sciences started the second half of 2025 with momentum driven by strong Q2 sales increases, successful introduction of new products, and a streamlined financial structure. Leadership reaffirmed its target of achieving 50% yearly revenue growth, highlighting a strategic move to concentrate efforts on the growing TriNav platform and effective market execution, along with anticipated cuts in research and development costs associated with nelitolimod. The company anticipates better operational efficiency, ongoing product acceptance, and a move towards positive cash flow in early 2026, showing strong confidence in its growth path and commercial approach.

Read the complete Earnings Call Transcript

More about TriSalus Life Sciences

- TriSalus Life Sciences, Inc. (TLSI) Second Quarter 2025 Earnings Call Transcript

- TriSalus Life Sciences, Inc. (TLSI) First Quarter 2025 Earnings Conference Call Transcription

- TriSalus Life Sciences reported a GAAP earnings per share of $0.27, which exceeded expectations by $0.48, and revenue of $11.2 million, surpassing estimates by $0.51 million.

- TriSalus Life Sciences introduces preferred stock trading

- Seeking Alpha's Quant Rating for TriSalus Life Sciences