Kraft Heinz is facing a split, a decade after Warren Buffett's £47 billion large-scale merger did not deliver the anticipated growth.

The consumer products division, which includes Heinz ketchup and Philadelphia cream cheese, is set to split into two separate entities as part of an effort to boost its declining performance.

Billionaire investor Buffett, whose company Berkshire Hathaway holds a 27 percent stake in the group, expressed his disappointment regarding the division.

Investors showed little interest, causing the stock to drop over 7 per cent in New York yesterday.

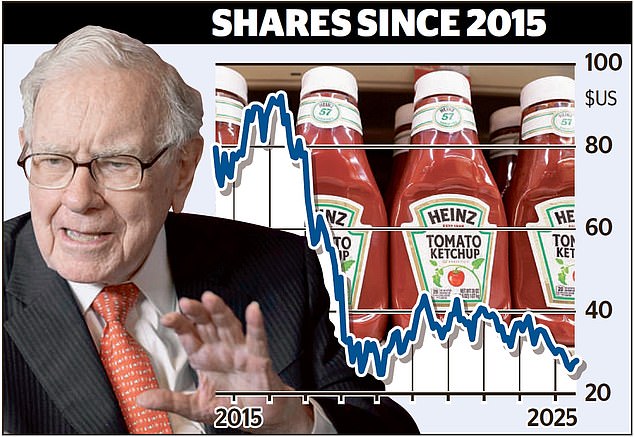

The fifth-largest food and beverage company globally was formed through a £47 billion merger between Kraft and Heinz in 2015.

It was conceived by Buffett, who has recently declared his retirement, along with the Brazilian private equity company 3G Capital.

The plan was to leverage its massive size. However, shifting preferences, as customers moved towards healthier choices, made the company's strategies more challenging.

Although efforts were made to enhance the growth of premium brands, it has still faced challenges, with sales declining by 3 per cent in the previous year.

The group's stock value has dropped by 75% from its highest point in 2017.

The firm mentioned in May that it is carrying out a strategic evaluation, indicating a possible division. It anticipates the deal to be finalized in the latter part of 2026.

Executive chairman Miguel Patricio stated yesterday: 'The brands of Kraft Heinz are renowned and cherished, yet the intricacy of our present structure poses difficulties in efficiently allocating capital, focusing on initiatives, and achieving growth in our most promising sectors.'

The split is not merely the opposite of the initial merger. One company, temporarily named the Taste Elevation Co, will concentrate on sauces and seasonings such as Heinz, Philadelphia, and Kraft Mac & Cheese.

Several brands such as Oscar Mayer, Kraft Singles, and Lunchables will be grouped into a US-based company, currently known as North American Grocery Co.

The group mentioned that the official names of the two companies will be revealed at a future time.

Alongside competitors such as Unilever and Nestle, Kraft Heinz is encountering difficulties, including Donald Trump's unpredictable trade policies and increasing food costs.inflation.

In response to the division, Buffett stated to CNBC broadcaster: 'We will take actions that we believe are in the best interest of Berkshire.'

Greg Abel, set to succeed him at Berkshire Hathaway by the end of this year, has already sent a letter to Kraft Heinz conveying his dissatisfaction, according to Buffett.

Russ Mould, an investment director at the brokerage AJ Bell, stated: "It's possible that the downfall of this food giant was always inevitable, but dealing with recent price increases and shifting consumer preferences has significantly impacted the company."

Heinz started out as a horseradish manufacturer in Pittsburgh, Pennsylvania, established by Henry J Heinz in 1869.

The beginnings of Kraft can be traced to the wholesale cheese delivery company established by James L Kraft in Chicago, in 1903.